Day 1: How gap years save money

May 25, 2016

Popularity of gap years among high school graduates has shot up in the last decade according to the American Gap Association. The year after high school in which students delay attending college does not always entail traveling, but is often used for work to have money for future expenses.

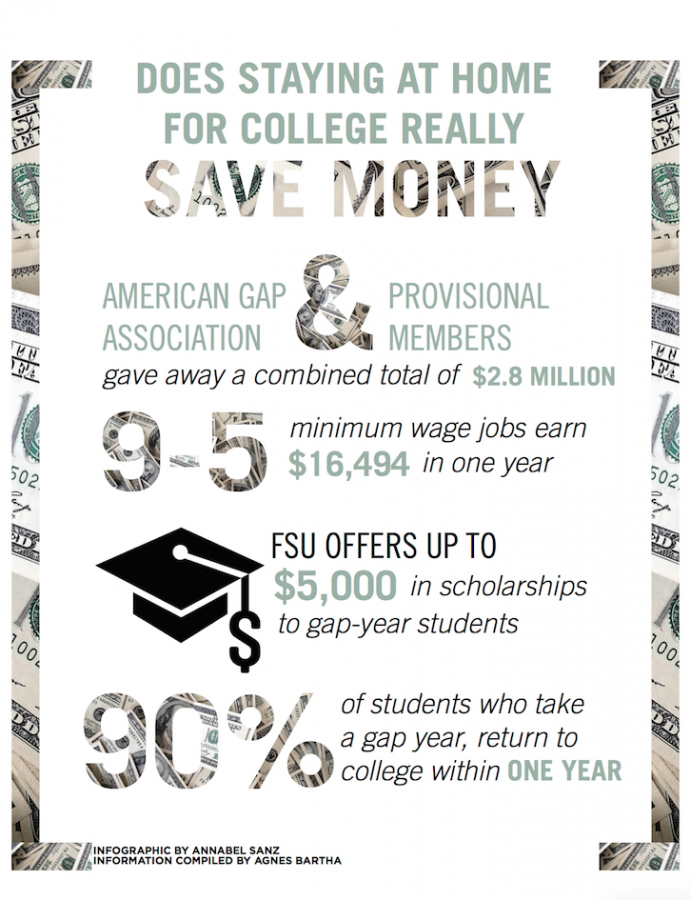

Taking a gap year to work on a nine-to-five minimum wage job earns $16,494 in one year, enough to pay for over two years at Florida International University or four-fifths of a year at University of Florida or Florida State University.

FSU offers up to $5,000 in funding to students taking a gap year. Princeton, Tufts and Oberlin also offer scholarships and financial assistance specifically to travel, volunteer or complete an internship. The year can teach students more than the classroom does about life in the outside world, knowledge top universities encourage students to have.

Earning such a scholarship while working a nine-to-five minimum wage job for a year can also allow a student to to enroll in the first year of FSU for free. This saves a hard-working student around $20,000 with valuable life experience: a truly beneficial give-and-take relationship.

FSU does not stand alone. In 2015, American Gap Association members and Provisional Members gave a combined total of $2.8 million in scholarships and need-based grants for students in the United States taking gap years. Students are funded for delaying college.

Yet in the case of immediately entering school, FSU’s yearly tuition remains above $20,000. Taking a year to relax without working as opposed to beginning a college education immediately delays payments of potential student loans, supplies and housing costs later on, without outside financial help.

Though returning to school after a gap year may leave the student a year behind their age group, not drowning in student loans as a member of the work force puts the student two years ahead. Debt from student loans often has adults delay purchasing a home, car or even marriage for over a decade after college graduation. With a solid plan, steady income and growing economy, it takes ten years to pay off student loans with a standard repayment plan.

Unfortunately for those taking the opportunity to work to minimize their loans, ten percent of students taking a gap year do not return to college according to the American Gap Association. In a world where entry level jobs typically require a college diploma and years of work experience, an alternate route into the professional world may flutter into consideration. Something along the lines of becoming the new Bill Gates sounds just fine; go ahead and skip the step of dropping out of Harvard.

Since the cookie-cutter high school student is not a technological genius entrepreneur, they start college right off the bat and often take on student loans as a consequence. American society dreads the thought of someone taking time off to learn something about themselves, but students in the United Kingdom follow the gap year tradition back to the 1970s. Universities in the United States have begun to offer scholarships for it in hopes of encouraging students to get a perspective on worldly culture and careers they would be more interested in. Essentially, delaying college can save money but only if you work through it.